Why Picking the Right Validator and Tracking Your Solana Portfolio Matters More Than You Think

Whoa! The Solana ecosystem has been buzzing nonstop lately, and honestly, it feels like just yesterday I was fumbling with basic wallets. Now, here we are juggling portfolio tracking, validator selections, and diving deep into DeFi protocols. It’s wild how fast things evolve. For a lot of us, staking SOL isn’t just about locking funds—it’s about trust, rewards, and safety all tangled up. But here’s what bugs me: many users overlook how critical validator choice is, or how messy it gets managing your assets across multiple DeFi platforms. If you’re like me, you’ve probably found yourself asking, “Am I even tracking my staking rewards right?”

Initially, I thought portfolio tracking was a straightforward task, mostly about watching prices and balances. But then I realized, nope—it’s way more layered. When you’re staking, your rewards depend heavily on the validators you pick, and not all validators are created equal. Some have better uptime, some are more trustworthy, and some just have funky fee structures that eat into your gains. So yeah, just choosing a validator blindly is a gamble, and that’s before you even consider how you’re juggling your DeFi positions.

Something felt off about many wallet interfaces I tried. They either buried the staking info or made it super confusing to monitor rewards in real time. Plus, if you’re hopping between DEXes, lending protocols, or liquidity pools on Solana, consolidating all that info can be a headache. My instinct said there had to be a better way, and that’s when I started digging into more specialized wallet extensions and tools.

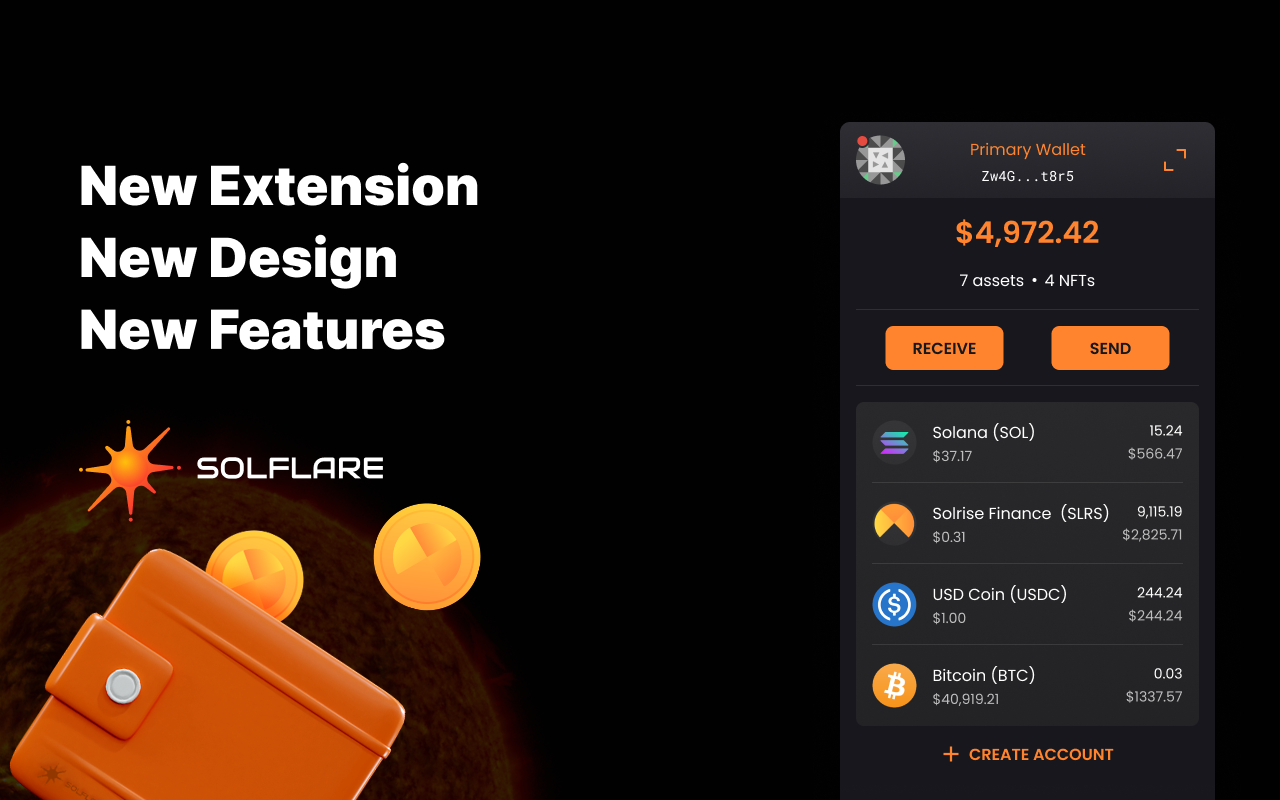

Okay, so check this out—there’s a wallet extension called solflare that really changed the game for me. It’s not just a wallet; it’s like a command center for your Solana assets. You can stake SOL, pick validators with transparent stats, and keep tabs on your DeFi involvement without hopping across a dozen tabs. The interface isn’t perfect (sometimes it lags a bit), but it strikes a balance between depth and usability that most other tools miss.

One thing I wasn’t expecting was how much the validator choice impacts not only your staking rewards but also the network’s health. On one hand, you want to maximize yield, but on the other hand, supporting sketchy or low-performance validators can risk your rewards or, worse, your principal. Initially, I picked validators just by their fees, but then I learned about their uptime scores and community reputation, which actually matter way more. So yeah, it’s a balancing act.

Tracking your Solana portfolio isn’t just about watching your total value grow or shrink daily. It’s about understanding where your assets are allocated, how each validator’s performance affects your staking returns, and how your DeFi positions are performing. This is where I see a lot of folks missing the bigger picture. For example, staking rewards might look good on paper, but if your validator goes offline often, you lose out. Similarly, some DeFi protocols promise juicy APRs but have hidden risks or complex fee structures that reduce your net gains.

Here’s the thing. I tried manually recording my staking rewards in spreadsheets, but it quickly became a mess—especially when switching validators or moving funds between protocols. The manual approach just doesn’t scale. That’s why wallets like solflare offer integrated portfolio tracking that automatically aggregates your staking rewards, validator stats, and DeFi positions. It’s not perfect, but it saves a ton of time and reduces errors.

Now, about validator selection—there’s a lot of noise out there. Some validators advertise ultra-low fees but have spotty uptime. Others have stellar reputations but charge high fees. Initially, I thought low fees meant more profit, but then realized uptime and reliability are king. Actually, wait—let me rephrase that: a validator with slightly higher fees but consistent uptime will almost always outperform a cheap, unreliable one when it comes to real returns. It’s a nuance that’s easy to overlook if you just glance at fees.

And don’t even get me started on the DeFi side. Solana’s ecosystem has exploded with lending, borrowing, liquidity pools, and yield farms. But the protocols vary wildly in terms of risk, rewards, and complexity. I jumped into a couple of popular pools and realized that tracking all my positions and rewards manually was nearly impossible without a good portfolio tracker. Plus, some protocols have lock-up periods or penalties that you need to watch out for—stuff that can catch you off guard.

Something else I learned recently is that diversification isn’t just a buzzword here. Spreading your stake across multiple validators can reduce risk from any single point of failure, but it also complicates tracking. If you’re staking on three different validators and farming in two DeFi protocols, your rewards come from multiple sources with different schedules and payout mechanisms. Without a tool that consolidates all this info, you’re flying blind.

By the way, I’ve noticed that wallets like solflare are pushing toward better validator transparency. They show uptime stats, fees, and even some community ratings right in the interface. This makes it way easier to make informed decisions rather than relying on random Twitter opinions or gut feelings alone. Still, I’m biased—I like having data at my fingertips rather than guessing.

Honestly, though, there’s no perfect validator or protocol. Things change, networks evolve, and new risks pop up. For instance, a validator that’s top-notch today might suffer an outage tomorrow, or a DeFi protocol might get hacked. So continuous monitoring is very very important. I try to set alerts and periodically review my portfolio to catch any red flags early.

Oh, and by the way, the Solana ecosystem’s speed and low fees make it really attractive for DeFi users, but that also means the market moves fast. You have to stay on your toes, or you’ll miss out on new opportunities—or worse, get caught in a bad one. It’s a bit like surfing: you want to catch the right wave, but if you’re not watching carefully, you wipe out.

At some point, I wondered if staking and DeFi were just too complex for the average user. But then I found that with the right tools, like the solflare wallet extension, the learning curve flattens out. The interface guides you through validator selection with helpful stats, and the portfolio tracker keeps everything consolidated. It’s not foolproof, but it definitely lowers the barrier to entry.

Still, there’s a lingering concern about security. With all these integrations and DeFi protocols, your surface area for attacks grows. I’m not 100% sure how safe every protocol is, and I’ve read horror stories about wallet exploits and phishing. That’s why I’m careful to only connect to trusted platforms and keep my keys offline when I can. No wallet is a silver bullet, but extensions like solflare have solid reputations and active community support, which helps.

One last thing I’ve been thinking about is the future of portfolio tracking in crypto. Right now, the fragmentation across wallets, validators, and DeFi protocols is a challenge. I suspect we’ll see more integrated solutions that combine real-time analytics, risk scoring, and maybe even AI-driven recommendations. But for now, tools like solflare are a practical step forward.

Honestly, tracking your Solana portfolio and choosing the right validator may not be the sexiest topics, but they’re foundational. Nail those, and everything else—staking rewards, DeFi yields, risk management—gets a lot easier. So if you’re deep into Solana, I’d say don’t just pick a validator at random or ignore your staking rewards. Take a bit of time, try out wallets like solflare, and keep a close eye on where your assets are and how they’re performing. You’ll thank yourself later.